News

A Generative Probabilistic Approach for Goal-Based Portfolio Optimization

Our paper “A Generative Probabilistic Approach for Goal-Based Portfolio Optimization“, authored by Bauman, T., Goluža, S., Mrčela, L., Begušić, S., and Kostanjčar, Z. has been accepted at the upcoming Conference on Neural Information Processing Systems (NeurIPS 2025) within the Workshop on Generative AI in Finance!

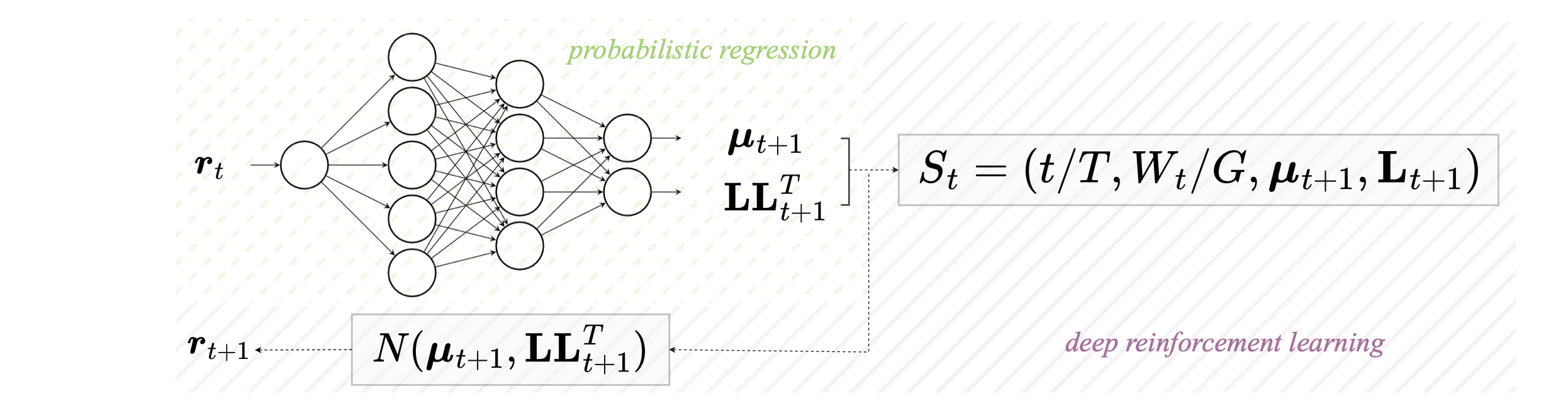

The paper proposes a generative modeling framework that integrates probabilistic regression with deep reinforcement learning for goal-based portfolio optimization. The proposed generative approach simulates realistic synthetic market trajectories, enabling the RL agent to train efficiently on diverse market scenarios and adapt to dynamic environments. The agent trained using the proposed generative model is shown to have significantly higher success rates across a wide range of financial goals.

October 2025