Can Artificial Intelligence help in predicting cash flow timing and patterns in international bank accounts? Our Laboratory has been working on answering this question in cooperation with the European Investment Bank, under the project Prediction of Cashflow Timing and Patterns in International Bank Accounts. The project was funded by the EIB institute as the first STAREBEI (STAges de REcherche BEI-EIB research internships) research grant with a Croatian university.

Project problem definition and motivation

The EIB performs its cash management based on cashflows expected from the lending, funding and treasury activities on the international markets. Better predicting the timing of intraday incoming payments from its multiple counterparties would improve its liquidity management and optimise prefunding decisions on EIB accounts thus reducing the associated costs.

Solution and results

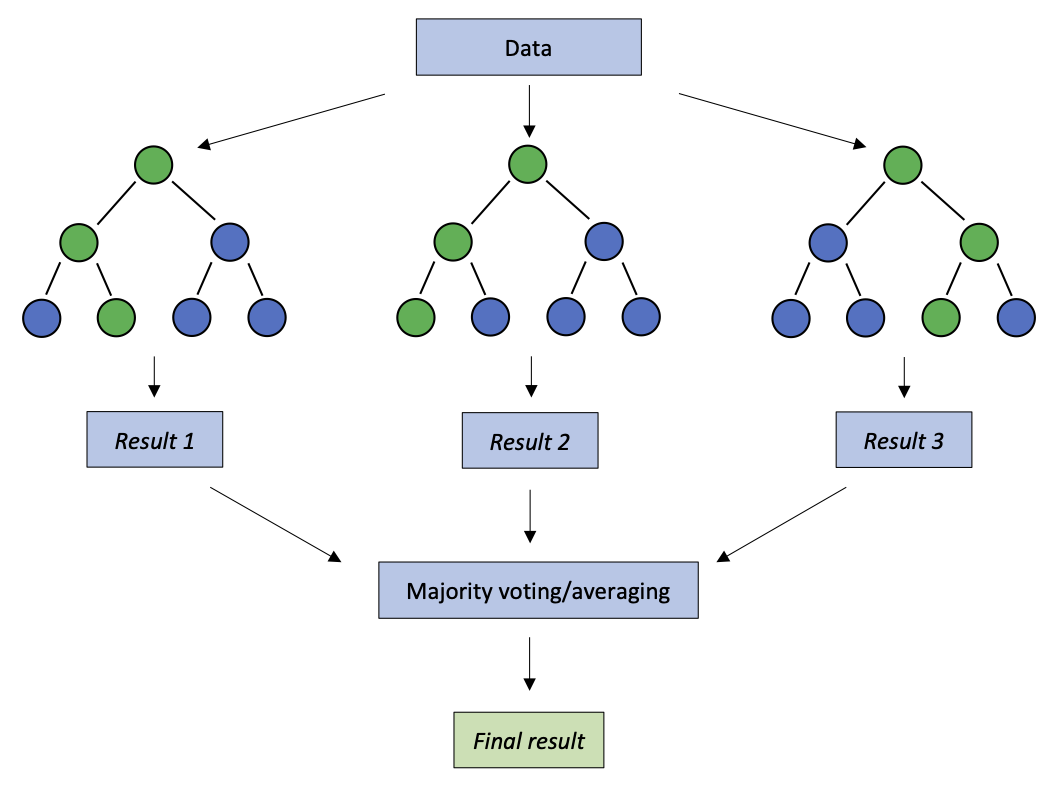

Based on three years of data provided by the EIB finance directorate, our researchers designed a machine learning (ML) model able to demonstrate predictibility of the inflows. ML based methods, specifically random forests lend themselves particularly well for the problem of cashflow timing prediction. The most important features found for this problem include:

- categorical features describing the counterparties, instruments, accounts and other descriptors of the expected inflows,

- temporal features, including cashflow dates, account open, close and cutoff times,

- combination of the above, describing the historical patterns of certain accounts, instruments and accounts.

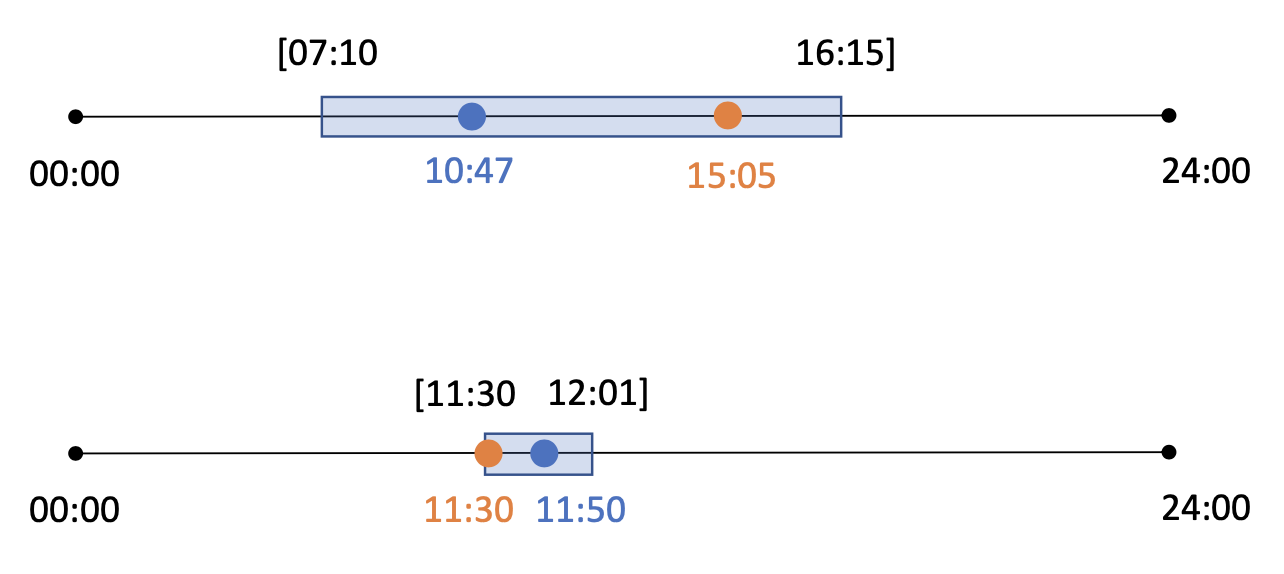

The trained models were found to predict intraday cashflow timing with a mean deviation of under 1 hour. However, this may not be enough information to make the model usable in practice, since some errors may be much lower and others can be much higher. To solve this problem, the model was designed to provide accurate prediction intervals as well, so that the experts on the EIB side who use it can also use the model’s certainty in specific predictions.

The prediction intervals were found to be accurate (for instance, the 90% prediction interval truly contained the real timing in 90% of the cases for out of sample data). These results demonstrated the potential of AI – after additional calibration and potential enhancements in live environment, the developed ML framework could provide a useful addition to the EIB’s liquidity management arsenal.

Project team members

- Assoc. Prof. Zvonko Kostanjčar, PhD, University of Zagreb

- Omar Aghzinnay, Head of Liquidity Planning and Control Unit, Back Office Treasury, EIB

- Stjepan Begušić, PhD, University of Zagreb

- Bruno Gašperov, MSc, University of Zagreb