Deep Reinforcement Learning Algorithms for Risk Management - DREAM

The DREAM project is funded by the Croatian Science Foundation, for a period of 4 years.

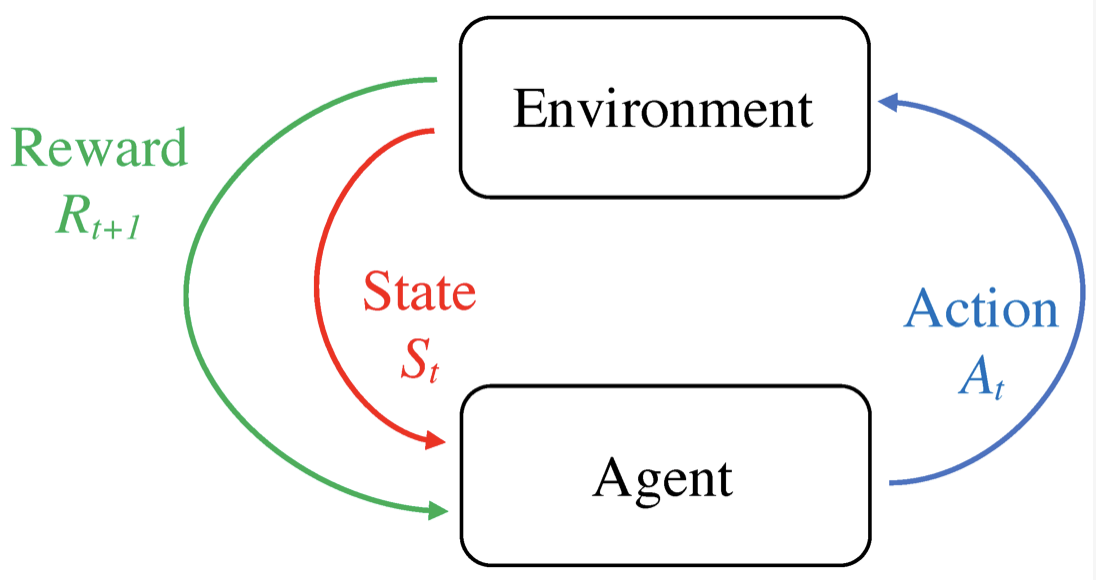

The goal of this project is to develop a novel class of risk-sensitive reinforcement learning algorithms in dynamic environments with applications in financial risk management. The objectives also include the implementation of state space representation models that extract information from time series data by exploiting latent factors and design of portfolio optimization algorithms based on proposed methods.

News

Reinforcement Learning Approaches to Optimal Market Making

We are happy to announce a new paper by the project team members under the title “Reinforcement Learning Approaches to Optimal Market Making" – published as a survey in the journal Mathematics.

The paper provides a comprehensive and up-to-date overview of the current state-of-the-art applications of (deep) reinforcement learning focused on optimal market making. The analysis indicated that reinforcement learning techniques provide superior performance in terms of the risk-adjusted return over more standard market making strategies, typically derived from analytical models.

To see more, please visit the publisher website. The paper is open access and is available for download.

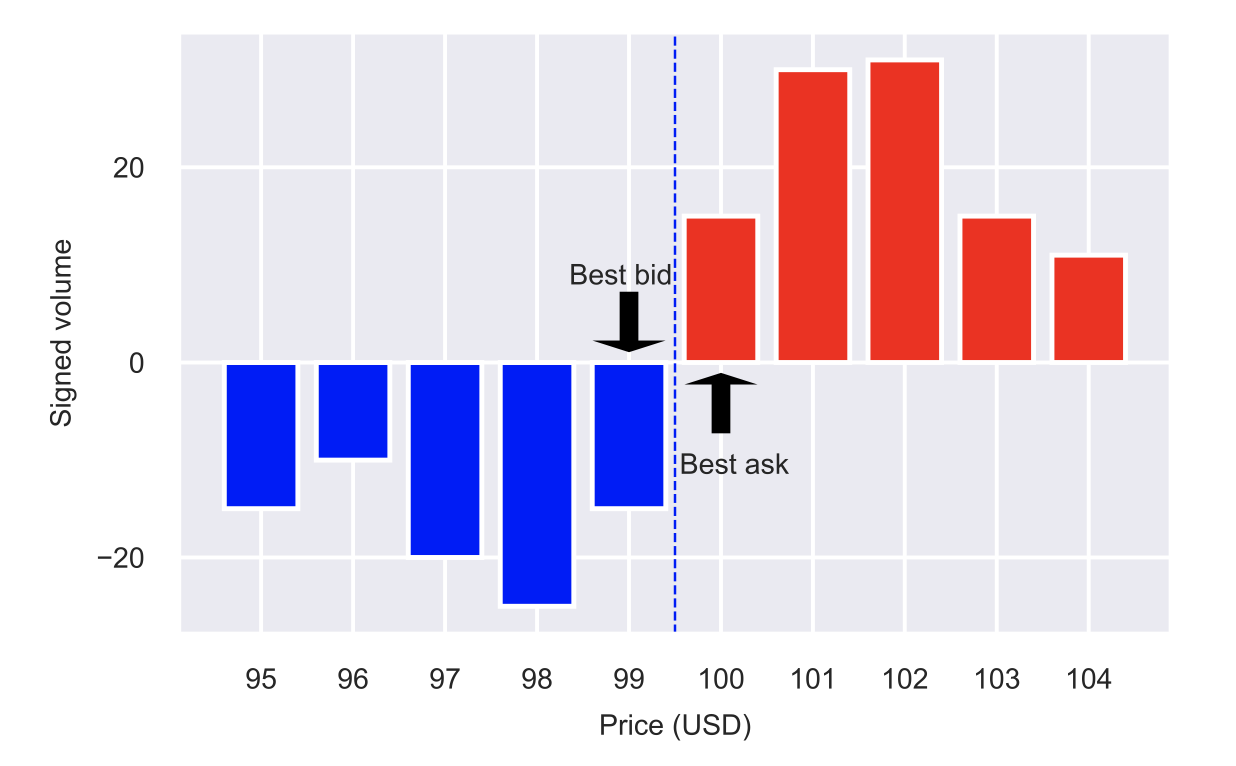

Market Making with Signal through Deep Reinforcement Learning

New paper authored by the project team members under the title “Market Making With Signals Through Deep Reinforcement Learning" has recently been published in the journal IEEE Access.

In this paper, we present a novel framework for market making with signals based on model-free deep reinforcement learning, addressing these shortcomings. A new state space formulation incorporating outputs from standalone signal generating units, as well as a novel action space and reward function formulation, are introduced. The framework is underpinned by both ideas from adversarial reinforcement learning and neuroevolution. Experimental results on historical data demonstrate the superior reward-to-risk performance of the proposed framework over several standard market making benchmarks. More specifically, the resulting reinforcement learning agent achieves between 20-30% higher terminal wealth than the benchmarks while being exposed to only around 60% of their inventory risks.

To see more, please visit the publisher website. The paper is open access and is available for download.

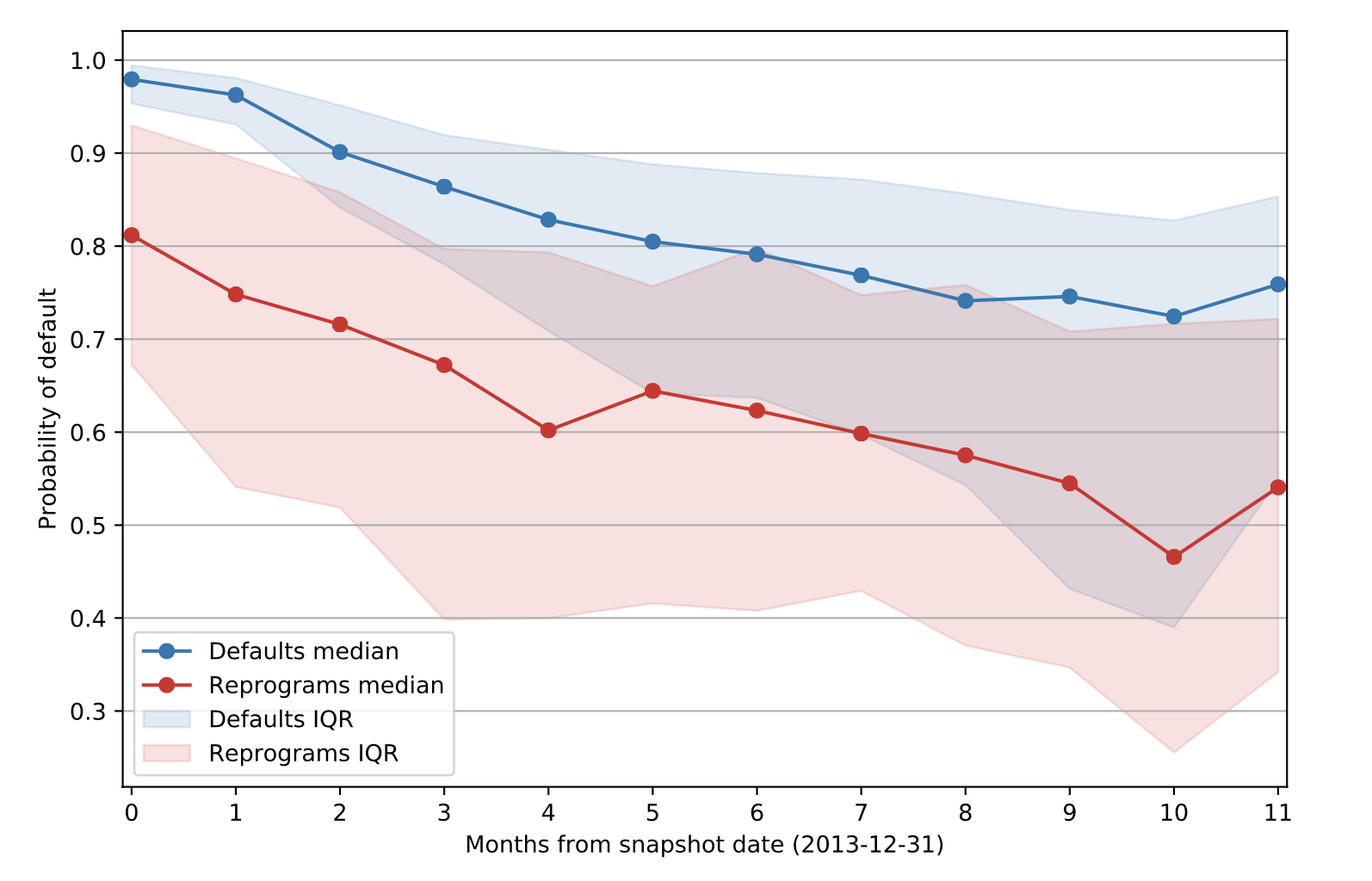

Deep Neural Networks for Behavioral Credit Rating

New paper under the title “Deep Neural Networks for Behavioral Credit Rating" has recently been published in the journal Entropy, as a part of a special issue: Human-Centric AI: The Symbiosis of Human and Artificial Intelligence.

Within this paper, a deep neural network model for behavioral credit rating was proposed. The proposed deep neural network was trained on two different datasets: the first one contains information on loans between 2009 and 2013 (during the financial crisis) and the second one from 2014 to 2018 (after the financial crisis); combined, they include more than 1.5 million examples. The proposed network outperformed multiple benchmarks and was evenly matched with the XGBoost model. Long-term credit rating performance is also presented, as well as a detailed analysis of the reprogrammed facilities’ impact on model performance.

To see more, please visit the publisher website. The paper is open access and is available for download.

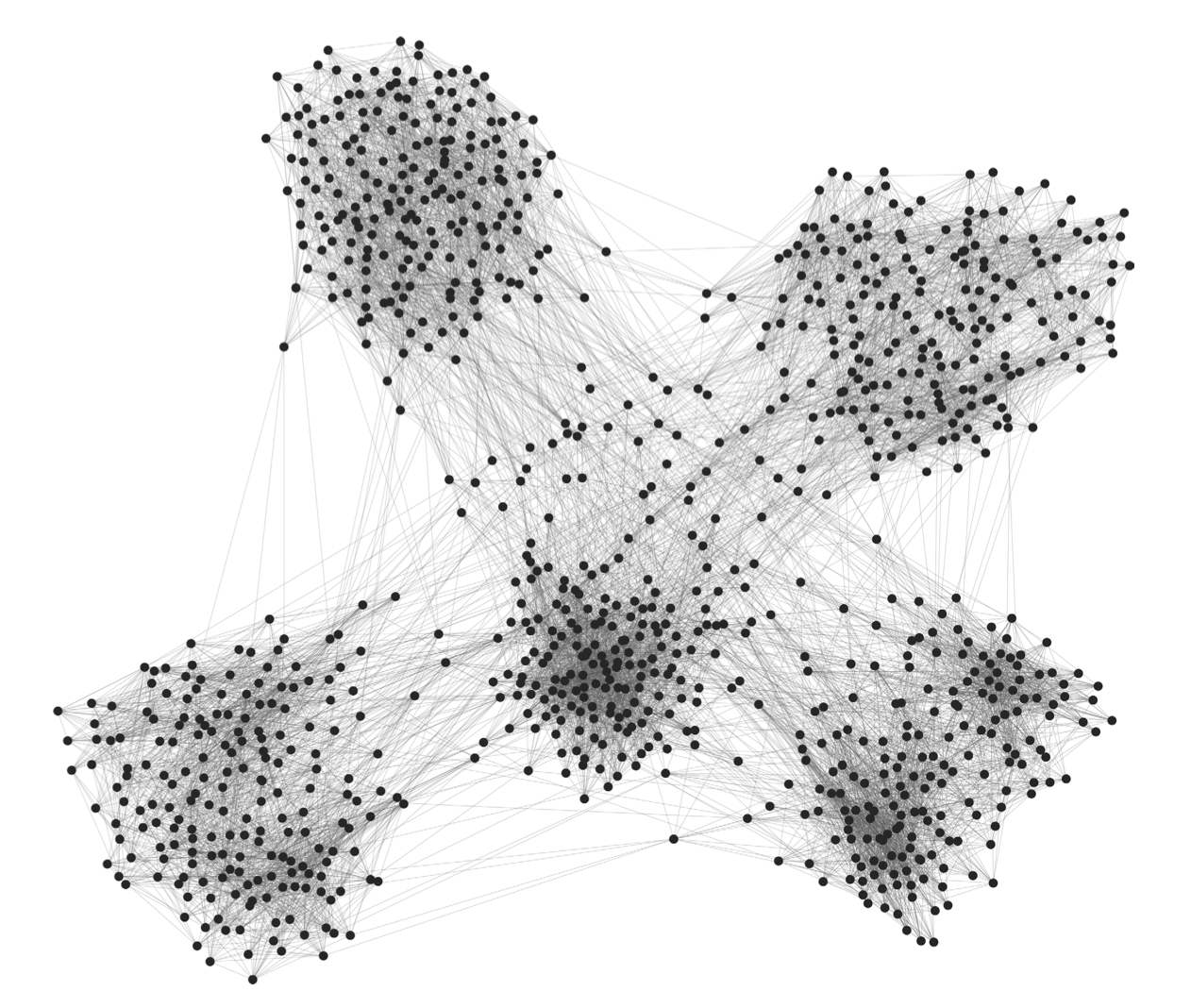

Cluster-Specific Latent Factor Estimation in High-Dimensional Financial Time Series

New paper under the title “Cluster-Specific Latent Factor Estimation in High-Dimensional Financial Time Series" has recently been published in the journal IEEE Access.

In this paper high-dimensional financial time series with pervasive and cluster-specific latent factors are considered. A clustering and latent factor estimation method is proposed, together with a model selection algorithm, based on the spectral properties of asset correlation matrices and asset graphs. A simulation study with known data generating processes demonstrates that the proposed method outperforms other clustering methods and provides estimates with a high degree of accuracy. Moreover, the proposed methods were applied to datasets of asset returns from global financial markets using a backtesting approach. The results demonstrate that the clustering approach and estimated latent factors yield relevant information, improve risk modelling and reduce volatility in optimal minimum variance portfolios.

To see more, please visit the publisher website. The paper is open access and is available for download.

Project team

- Assoc. prof. Zvonko Kostanjčar, PhD – project leader

- Prof. Branko Jeren, PhD – senior researcher

- Asst. prof. Davor Zoričić, PhD – senior researcher

- Asst. prof. Petra Posedel Šimović, PhD – senior researcher

- Stjepan Begušić, PhD – postdoctoral researcher

- Tessa Bauman – PhD student

- Bruno Gašperov – PhD student

- Sven Goluža – PhD student

Publications

- T. Kovačević, S. Goluža, A. Merćep, and Z. Kostanjčar, “Effect of labeling algorithms on financial performance metrics," 45th Jubilee International Convention on Information, Communication and Electronic Technology (MIPRO), 980–984., Jun 2022, doi: 10.23919/MIPRO55190.2022.9803522

- B. Gašperov, and Z. Kostanjčar, “Deep Reinforcement Learning for Market Making Under a Hawkes Process-Based Limit Order Book Model,” IEEE Control Systems Letters, 6, 2485–2490, Apr. 2022, doi: 10.1109/LCSYS.2022.3166446.

- B. Gašperov, S. Begušić, P. P. Šimović, and Z. Kostanjčar, Reinforcement Learning Approaches to Optimal Market Making, Mathematics 2021, Vol. 9, Page 2689, vol. 9, no. 21, p. 2689, Oct. 2021, doi: 10.3390/MATH9212689

- B. Gašperov and Z. Kostanjčar, Market Making with Signals through Deep Reinforcement Learning, IEEE Access, vol. 9, pp. 61611–61622, 2021, doi: 10.1109/ACCESS.2021.3074782

- A. Merćep, L. Mrčela, M. Birov, and Z. Kostanjčar, Deep Neural Networks for Behavioral Credit Rating, Entropy, 23(1), 27, 2021, doi: doi.org/10.3390/e23010027

- S. Begušić and Z. Kostanjčar, Cluster-Specific Latent Factor Estimation in High-Dimensional Financial Time Series, IEEE Access, 8, 164365-164379, 2020, doi: 10.1109/ACCESS.2020.3021898

- V. Keranović, S. Begušić, and Z. Kostanjčar Zvonko “Estimating the Number of Latent Factors in High-Dimensional Financial Time Series“, 2020 International Conference on Software, Telecommunications and Computer Networks (SoftCOM)“, (20114528), Hvar, Croatia, Sep. 2020. doi: 10.23919/softcom50211.2020.9238229